Office Hours

9:00 AM - 5:00 PM

Our Location

Dacula, GA

Call Us Now

770-314-7648

Affordable health insurance

Do you have a PPO Did Rates increase?

Average Heart Attack cost $780k are you covered?

Pay a copay?

High Deductible?

We Have You Covered

HEALTH

Shop on and off the Market place to find the best coverage!

Any Doctor, Any Hospital!

24 hour coverage, on or off the job

Portable coverage

Quality coverage available for periods of critical illness

Wellness & Health Screening Benefits Available

Exclusive non-advertised private affordable health insurance PPO

DENTAL

Tailored for Your Needs

ALL PPO's

Preventative Dental Care Coverage

Basic Dental Care Coverage

Major Dental Care Services Available

Orthodontic Care Services Available.

VISION

Up to 84% Savings on Vision Services

Over 71,000 Providers to Choose From

Comprehensive Eye Exam Coverage

Corrective Lenses Coverage

Corrective Contact Lenses Coverage

Annual Allowance Towards Frames

All PPO networks

Quick Individual or Family Rate

Frankly Health will never share your information.

Assigned one agent and never placed on a call list!

_____________

Our Commitment

Christian values are at the core of our relationships with our clients.

Knowledge of Markets

We work tirelessly to stay informed about the latest changes in the healthcare markets. We can provide you information on what is available for your situation and any expected changes.

13 Years Experience

We pride ourselves in finding the perfect insurance package for your family, providing suitable coverage. Our expertise lies in reducing costs for medical consultations, prescription drugs, and preventive healthcare services. We offer the best options for affordable PPO health insurance plans.

Reviews

Betty "B" Hays Tampa FL

★★★★★

After speaking to many agents and losing hope, I made an appointment with Frank. I shared the heartbreaking news about my daughter's cancer and ended the call abruptly. Surprisingly, Frank reached out to me over the next few days, promising to help. Late one night, I called him again and he found a comprehensive coverage plan for my family at half the cost. He secured a policy that covered my daughter's treatment and arranged a separate deductible for the rest of us. The hospital benefits paid $800 per day, covering my daughter's expenses and our premiums for the year.

Alicia Jenson MD

★★★★★

A++ Customer service. They answer the phone day or night. I have received so many checks from the plan after I go to the doctors. The plan I picked was affordable and was taken by every doctor. No copays and locked in rates....great coverage,

DROP US A LINE

_____________

Frequently Asked Questions

SMALL BUSINESS FAQ

OUR HIGH CLAIMS MAKES OUR RATES HIGH?

We regularly solve this common issue with our comprehensive plans for cancer, MS, surgeries, and expensive RX claims. Our goal is to find the best plan for each team member's unique situation, saving money for the company and employees. We also prevent one employee's unfortunate circumstances from affecting their colleagues' rates.

ARE SMALL GROUP PLAN FROM MARKETPLACE BEST?

Small business marketplace plans often come with exorbitant costs and inadequate coverage. These plans typically offer subpar benefits, such as 50% coinsurance for most services, limited networks, high deductibles, high maximum out-of-pocket expenses, and most importantly, they are extremely expensive. Our aim is to find guaranteed renewable plans that eliminate the need for yearly shopping. For those who are better off on the marketplace, that's where they should remain. But we can show how to save on marketplace plans as well

WE JUST RENEWED OUR PLAN SO I GUESS WE ARE STUCK

Actually, the outcome depends on the tax structure. For example, if healthcare expenses are paid after taxes, we can increase the benefits the next month. If there is no minimum participant requirement in your plan, we can reduce it to one user and notify the other employees. There are many other ways to address this issue.

MARKETPLACE IS NOT AN OPTION OPEN ENROLLMENT IS CLOSED

Actually, if we were to substitute the employer plan, it would result in a special enrollment period, thereby granting access to all available options, including the marketplace.

INDIVIDUAL | FAMILY FAQ

ISN'T MY EMPLOYER PLAN THE BEST OPTION?

Employer plans are frequently expensive and provide unsatisfactory benefits. Without Frankly Health managing the benefits, you would end up contributing towards others' claims in the group. For instance, a 32-year-old male with High Blood Pressure and Hypothyroidism would pay $45 per week for a comprehensive plan with no annual deductible, no copay, including preventative, MD Live, accident protection, Hospital confinement protection, and critical illness protection.

I ALREADY PICKED A MARKETPLACE PLAN SO I CAN'T CHANGE

Actually you can change your marketplace plan at anytime. We would shop options and get our approval before making the change in benefits. Then you can start saving and getting better benefits.

WHAT IS THE DIFFERENCE BETWEEN NETWORKS?

Preferred Provider Organization (PPO): A type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

Point of Service (POS): A type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

Health Maintenance Organization (HMO): A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness

Exclusive Provider Organization (EPO): A managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

(Healthcare.gov 1/15/2024- Source)

MARKETPLACE WILL BE CHEAPER BECAUSE OF THE SUBSIDY

Actually marketplace plans can cost 75% more for similar coverage elsewhere. So if you get $100 subsidy every month but your plans rate is $525 originally and we can replace your plan with a $179 a month plan that has no copays for services and doesn't have a $9100 deductible and 50% coinsurance

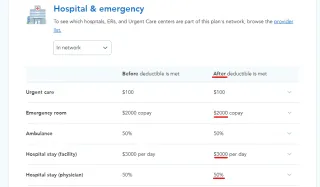

MARKETPLACE PLAN IS GREAT COVERAGE

Most are very surprised. It may but lets actually open the plan details and compare your benefits. Most people are surprised to find they have to pay 50% of the bill even after paying s high deductible.

I HAVE VERY EXPENSIVE MEDICATION SO I NEED MARKETPLACE

Actually, being enrolled in a subsidized plan disqualifies you from numerous savings on costly medications. Frequently, you can obtain more affordable and superior coverage outside the Marketplace. Consequently, you become eligible to receive those expensive medications at no cost or have them delivered for $100-400 annually.

MARKETPLACE PLANS PROTECT BEST FOR HOSPITALIZATIONS

Actually most people are surprised when we read the details. We have plans that offer 3k Max out of Pocket protection But marketplace after paying your High Deductible you could have a $2000 Emergency Room COPAY, $3,000 a per DAY COPAY or 50% Co-insurance

I HAVE SHORT_TERM COVERAGE BUT ITS GOOD FOR 3 YEARS

In those three years, you might lose eligibility for significantly improved coverage. Short-term plans won't be renewable after April 2024 due to alterations in insurance legislation.

We offer plans with a $2,500 deductible, a maximum out-of-pocket expense of $4,500, and first-dollar benefits that are guaranteed until the age of 65. Frequently, this PPO plan has a similar or lower premium cost.

Copyright©2022 Frankly Health Insurance. All Rights Reserved.

Powered by Faith in God