Office Hours

9:00 AM - 5:00 PM

Our Location

Dacula, GA

Call Us Now

770-314-7648

SMALL BUSINESS HEALTH

PLAN CONCIERGE CAN HELP!

MEC (Group Plans) Plans?

Individual OR Supplement Plan?

What's best for your business?

What are the benefits?

Benefit to EVERYONE

PPO nationwide networks

no copays for RX; Doctors; specialists; labs or preventative

No referrals needed

No special open enrollment

Employee special situations is considered individually

One employee falls ill it doesn't affect team's rates

Assigned agent available Day or Night

Benefit to EMPLOYER

Increase retention and invest in your experienced team

Rates don’t increase based on usage

Save 25%-50% over most Group Plans

Integrates into payroll

Rates increase 1-3% a year

New employees enrollment

Employees are provided 1:1 meetings to fully understand the plan

Add the additional benefits to your hiring post

Other Benefits

PPO Dental - PPO Vision - Life - Income Protection - Long Term Disability - Short Term Disability - Catastrophic Coverage - Critical Illness Protection

Included in most states-

MD Live Unlimited

Family Accident Protection

Family AD&D

Family Hospital Confinement

Discounts on travel, payroll, 1-800 flowers , office supplies and shipping

We have a simple automated process

Most Small Business Plans can initiate coverage quickly as little as 72 hours

Complete employer intake & schedule five minute intake appt (SEE BELLOW)

Employees intake, appointment to discuss plans, features & budget

Employer Approves the plans

Every employee has there agents cell phone

Frequently Asked Questions

SMALL BUSINESS FAQ

OUR HIGH CLAIMS MAKES OUR RATES HIGH?

We regularly solve this common issue with our comprehensive plans for cancer, MS, surgeries, and expensive RX claims. Our goal is to find the best plan for each team member's unique situation, saving money for the company and employees. We also prevent one employee's unfortunate circumstances from affecting their colleagues' rates.

ARE SMALL GROUP PLAN FROM MARKETPLACE BEST?

Small business marketplace plans often come with exorbitant costs and inadequate coverage. These plans typically offer subpar benefits, such as 50% coinsurance for most services, limited networks, high deductibles, high maximum out-of-pocket expenses, and most importantly, they are extremely expensive. Our aim is to find guaranteed renewable plans that eliminate the need for yearly shopping. For those who are better off on the marketplace, that's where they should remain. But we can show how to save on marketplace plans as well

WE JUST RENEWED OUR PLAN SO I GUESS WE ARE STUCK

Actually, the outcome depends on the tax structure. For example, if healthcare expenses are paid after taxes, we can increase the benefits the next month. If there is no minimum participant requirement in your plan, we can reduce it to one user and notify the other employees. There are many other ways to address this issue.

MARKETPLACE IS NOT AN OPTION OPEN ENROLLMENT IS CLOSED

Actually, if we were to substitute the employer plan, it would result in a special enrollment period, thereby granting access to all available options, including the marketplace.

INDIVIDUAL | FAMILY FAQ

ISN'T MY EMPLOYER PLAN THE BEST OPTION?

Employer plans are frequently expensive and provide unsatisfactory benefits. Without Frankly Health managing the benefits, you would end up contributing towards others' claims in the group. For instance, a 32-year-old male with High Blood Pressure and Hypothyroidism would pay $45 per week for a comprehensive plan with no annual deductible, no copay, including preventative, MD Live, accident protection, Hospital confinement protection, and critical illness protection.

I ALREADY PICKED A MARKETPLACE PLAN SO I CAN'T CHANGE

Actually you can change your marketplace plan at anytime. We would shop options and get our approval before making the change in benefits. Then you can start saving and getting better benefits.

WHAT IS THE DIFFERENCE BETWEEN NETWORKS?

Preferred Provider Organization (PPO): A type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

Point of Service (POS): A type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

Health Maintenance Organization (HMO): A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness

Exclusive Provider Organization (EPO): A managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

(Healthcare.gov 1/15/2024- Source)

MARKETPLACE WILL BE CHEAPER BECAUSE OF THE SUBSIDY

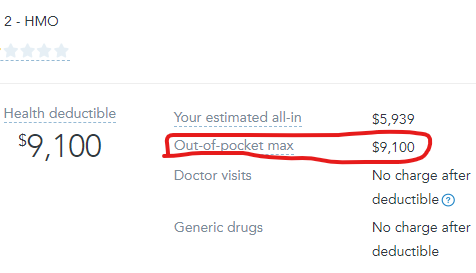

Actually marketplace plans can cost 75% more for similar coverage elsewhere. So if you get $100 subsidy every month but your plans rate is $525 originally and we can replace your plan with a $179 a month plan that has no copays for services and doesn't have a $9100 deductible and 50% coinsurance

MARKETPLACE PLAN IS GREAT COVERAGE

Most are very surprised. It may but lets actually open the plan details and compare your benefits. Most people are surprised to find they have to pay 50% of the bill even after paying s high deductible.

I HAVE VERY EXPENSIVE MEDICATION SO I NEED MARKETPLACE

Actually, being enrolled in a subsidized plan disqualifies you from numerous savings on costly medications. Frequently, you can obtain more affordable and superior coverage outside the Marketplace. Consequently, you become eligible to receive those expensive medications at no cost or have them delivered for $100-400 annually.

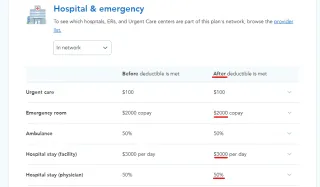

MARKETPLACE PLANS PROTECT BEST FOR HOSPITALIZATIONS

Actually most people are surprised when we read the details. We have plans that offer 3k Max out of Pocket protection But marketplace after paying your High Deductible you could have a $2000 Emergency Room COPAY, $3,000 a per DAY COPAY or 50% Co-insurance

I HAVE SHORT_TERM COVERAGE BUT ITS GOOD FOR 3 YEARS

In those three years, you might lose eligibility for significantly improved coverage. Short-term plans won't be renewable after April 2024 due to alterations in insurance legislation.

We offer plans with a $2,500 deductible, a maximum out-of-pocket expense of $4,500, and first-dollar benefits that are guaranteed until the age of 65. Frequently, this PPO plan has a similar or lower premium cost.

Copyright©2022 Frankly Health Insurance. All Rights Reserved.

Powered by Faith in God